401(k) FAQs for accountants and advisors

Do your clients have questions about offering a 401(k) plan? We’ve got most of the answers accountants and advisors need right here!

This article is the third in a three-part series that’s designed to help tax pros and investment advisors give their clients great advice about 401(k) plans. We'll go deep into the nitty gritty of what makes 401(k) plans tick, but you can also brush up on the why and how of 401(k)s in the first two articles:

- Part 1: Why tax pros should be up to speed on retirement plans

- Part 2: How to help your clients choose the right 401(k) provider

A 401(k) refresher (if you need it)

First things first — what is a 401(k)? Sometimes you’ll hear people refer to a 401(k) as a type of defined contribution plan. That means participants make or receive specific contributions to their retirement account, but their retirement payout will not be guaranteed — it’s ultimately based on the performance of investments that are held within the plan. The other type of qualified retirement plan, a defined benefit plan, gives participants a guaranteed benefit based on things like how long they work and how much they’ve earned. Pensions are an example of a defined benefit.

Defined contribution plans are sponsored by employers, who make decisions about their company’s plan and are responsible for making sure sure it is administered for the benefit of employee participants. Each employee’s account can be funded by their employer — using a specific formula based on employee compensation — or when an employee defers a portion of their pay. Whether the funds in an account are employer contributions or employee deferrals, funds go into a trust account for the benefit of participants, where they accrue earnings. At some point in the future, the employee will take distributions from their account.

IRS rules set limits for the amount of elective deferral contributions employees can make to their accounts each year. For 2020, that limit is $19,500. Employees age 50 or over can make an additional $6,500 in catch-up contributions.

The tax advantages of a 401(k)

One of the attractive features of a 401(k) plan are the tax advantages for employees and employers:

For employers:

- Thanks to the 2019 SECURE Act, eligible businesses may be able to claim a tax credit of up to $15,000 over the first three years of their plan (previously $1,500). The IRS credit covers 50% of all “ordinary and necessary” costs companies incur to set up a qualified retirement plan — up to a maximum of $500 or $250 per participating NHCE (limited to $5,000) per year three years.

- The SECURE Act has also added a new Small Plan Autoenrollment Credit of up to $500 per year for three years for plans that add an Eligible Automatic Contribution Arrangement (EACA) for the first time. The credit is not limited to plan expenses and is in addition to the start-up credit.

- Eligible costs associated with administering the plan can be deducted as business expenses, further reducing taxable income.(But note that a business can’t take a credit and deduct the same costs.)

- Employer contributions to participant accounts are deductible from federal and state income taxes and exempt from payroll taxes — as long as they are under 25% of the total eligible compensation paid (or accrued) during the year and must be deposited in the plan’s trust by the employer’s tax filing deadline for that year, plus extensions.

For employees:

- Traditional 401(k) contributions: Employees make contributions to Traditional 401(k) plans on a pre-tax basis. That means the amount of taxable wages will be lower when they contribute to their 401(k) accounts. Participants are eventually taxed when they withdraw funds from their 401(k), but they’re usually in a lower tax bracket by that time.

- Roth 401(k) contributions: Employees make contributions to Roth 401(k) plans on a post-tax basis. That means they pay taxes up front on elective deferrals, but their funds will grow and be distributed without being taxed (generally, as long as their account is open for at least five years).

Up the ante: Matching and profit-sharing

Businesses that offer a 401(k) are not required to make any contributions to their employees, but more than half of our clients choose to. Matching contributions can have a few huge benefits for everyone involved:

- Contributions from employers mean extra money for participants, which helps attract and retain employees

- As an expense, they reduce the taxable income of the business

- They can make it easier to keep a 401(k) plan compliant (for an example, see the “Safe Harbor” section below)

- They allow owners and other well-compensated employees to save more than the annual $19,500 limit

While participants may only contribute $19,500, employer contributions to matching and profit sharing plans allow participants to potentially sock away up to $57,000 in 2020 when employee deferrals and employee contributions are combined ($63,500 with catch-up contributions for participants over 50).

Are 401(k)s required?

No states currently require employers to offer a specific kind of retirement plan, but several states have passed legislation that establishes a state-sponsored retirement plan (like CalSavers in California and OregonSaves in Oregon) and/or mandates that businesses provide a retirement plan. These state-sponsored plans are a helpful step for putting employees in better shape to retire, but a well-run 401(k) plan can mean lower fees for businesses and employees, so it’s worth shopping around.

How do company owners and partners contribute to a 401(k)?

It’s likely that your client is an owner of one or a number of businesses. They may be a shareholder in an S-Corporation, a member of an LLC, a general partner of a limited partnership, a sole proprietor, or maybe a combination of many of these (or others!). It’s also possible that if an owner of a business offers a 401(k) plan to her employees, she will want to participate in the plan, too.

Depending on the type of owner, certain owners who wish to take part in the 401(k) plan must meet certian criteria:

- With the exception of sole proprietors and partners,owners must be a W-2 employee of the business and defer part of their wages, up to $19,500 ($26,000 if over age 50) or 100% of wages, whichever is less. They’ll also be eligible to receive employer profit sharing and matching. OR

- For sole proprietors and partners, the business must be profitable. Owners can make contributions based on taxable self-employment earnings from the business sponsoring the plan. This deferral amount is calculated when taxes are prepared, and must be deposited before the tax filing deadline. A business owner can contribute up to the lesser of $19,500 ($26,000 if over 50) or 100% of adjusted taxable earnings.

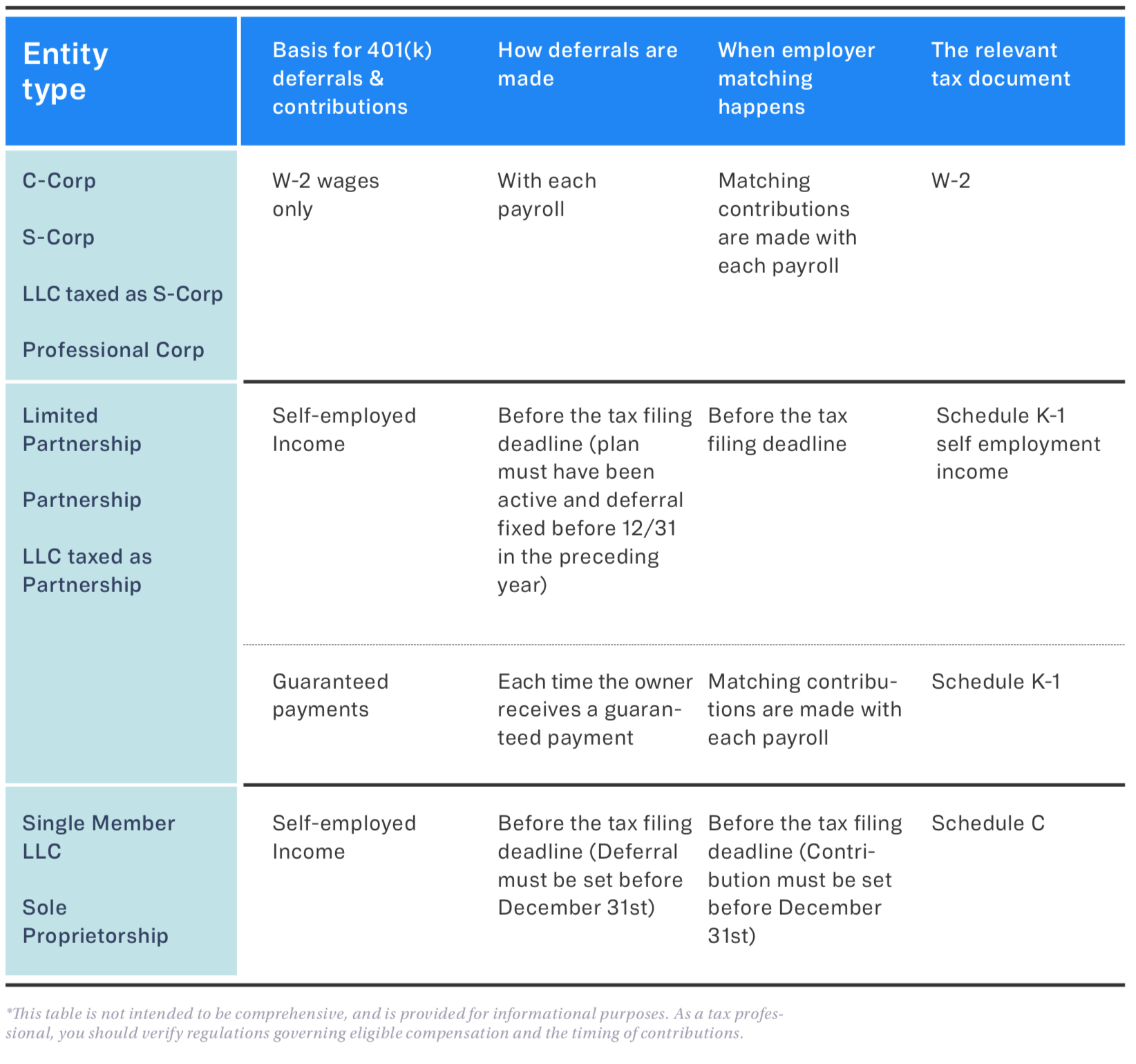

There are lots of rules around ownership and 401(k) participation, so this chart should help sort through most scenarios:

What do I need to do to stay compliant? And what’s a Safe Harbor 401(k) plan?

One of the big things a good 401(k) provider (or its third party administrator) does is perform compliance monitoring and annual nondiscrimination testing — most notably the Actual Deferral Percentage (“ADP”) and Actual Contribution Percentage (“ACP”) tests. These tests are designed to make sure highly compensated employees (HCE) aren’t the only ones that benefit from a company’s plan. These tests compare deferral and contribution rates between HCEs and non-HCEs, to make sure non-HCEs are benefitting from the plan.

You can learn a lot more about compliance testing here, but there are a few scenarios where companies are at risk of failing testing (even if they’re doing everything they can to run an equitable plan):

- Small company size: It’s easy for the ratio to get out of whack when the sample size is very small — such as in companies with fewer than 10 employees.

- HCEs with low wages: When owners and managers have low wages and they make (relatively) large contributions, it can lead to testing failures.

- Large wage discrepancy: Businesses with lots of hourly employees, especially, can run into compliance issues.

- High proportion of owners to other employees

- Plans that start late in the year: When a plan is launched near the end the year, HCEs may try to make a full year’s worth of contributions, while non-HCEs won’t have the financial flexibility to do so.

Safe Harbor to the rescue

One recommendation you can make for clients who wish to keep their 401(k) plan compliant — and simple — is to suggest a Safe Harbor plan. A Safe Harbor 401(k) plan exempts its sponsors from annual discrimination testing. To qualify as a Safe Harbor plan, a sponsor must make contributions to participants’ accounts, and those contributions must vest immediately. There are a number of ways to meet this requirement:

- Basic match. The employer matches 100% of the 401(k) deferrals each participant makes, up to 3% of that employee’s pre-tax compensation. The employer also agrees to match 50% of the next 2% of compensation that is deferred.

- Enhanced match. The employer matches 100% of the 401(k) deferrals each participant makes, up to 4% to 6% of deferred compensation.

- Non-elective contribution. The employer contributes a certain amount to all employees eligible to participate in the plan, whether or not they make 401(k) deferrals. The Safe Harbor non-elective minimum is 3% of compensation.

It’s important to remember that Safe Harbor contributions must immediately vest for all employees. You can learn more about in our comprehensive Safe Harbor 401(k) guide.

More key 401(k) considerations

Profit sharing

Another great option to recommend to clients who can afford it is a profit-sharing feature. With profit sharing, the employer contributes a designated amount based on an IRS-approved formula. These amounts are usually based on employees’ salaries and deposited into their designated retirement accounts. Employees are not required to contribute to receive profit sharing contributions. These profit-sharing contributions grow on a tax-deferred basis.

Profit-sharing is a generous benefit. A tax professional’s counsel can be critical in helping them make a prudent decision about what level of profit sharing to provide each year. Here’s some more detailed information if you want to dive in.

401(k) matching

Another generous benefit that many businesses like to offer is a 401(k) match. A match is a contribution by the company, following a specific formula — made to participants based on their own deferrals — as an incentive for them to contribute. Matching is not mandatory but it is an excellent way to attract and retain talent, and it provides a significant boost to your employees’ savings.

Switching from another type of retirement plan

If your client already offers another kind of retirement plan, like a SIMPLE IRA, a SEP IRA, or a 403(b) plan, they can always switch to a 401(k). It will be crucial for any client considering this change to know the difference between their current requirements and those of a 401(k) plan. Switching to a 401(k) could mean an increase in costs and resources required to stay compliant.

Third-party audit requirement

In addition to the IRS nondiscrimination tests, the Employee Retirement Income Security Act of 1974 (ERISA) requires an annual audit of large retirement plans (with more than 100 participants) by an independent Certified Public Accountant.

Tthe audit requirement is an important piece of compliance, and you should let clients know about it (and the added expenses it may require) when they set up a larger plan. Check out our article on audits or more specific information.

Need more help?

We tried our best to give you an overview here, but even the most seasoned tax pro is bound to come up against novel issues every now and then. If you have any additional questions — or want to know more about how Guideline makes it easy for tax pros to help clients with a 401(k), you can get in touch with us here.

Or go back to check out the other articles in this series:

- Part 1: Why tax pros should be up to speed on retirement plans

- Part 2: How to help your clients choose the right 401(k) provider

This content is provided for informational purposes only and is not intended to be construed as tax advice. As a tax professional, it is your responsibility to ensure you understand tax regulations and take your clients’ unique circumstances into account when furnishing tax advice.