Will CalSavers help California retirees strike gold?

Over 7.5 million of California’s workers lack access to a workplace retirement plan, but that’s about to change. By 2022, a new law will require employers in California with five or more employees to offer a retirement plan — either through the private market, or by giving their employees access to the new, state-run CalSavers program.

If CalSavers sounds like a big deal, it’s because it is. California lawmakers are calling it “the most ambitious push to expand retirement security since the passage of Social Security in the 1930s.”

What makes CalSavers tick?

For the time being, the job of implementing the CalSavers program falls on the shoulders of California State Treasurer John Chiang. As the only person to serve in the top three finance posts in the state of California, Treasurer Chiang is both passionate and deeply experienced with issues surrounding Californians’ household finances and retirement savings.

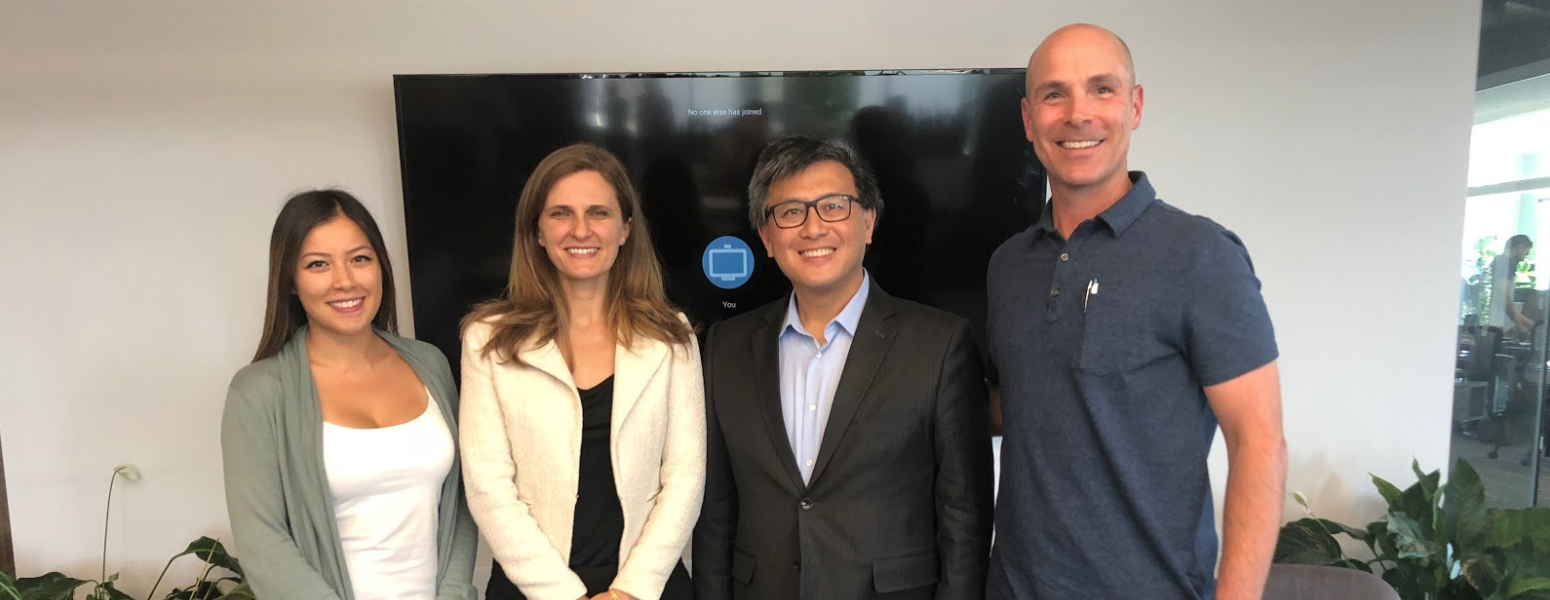

I recently had the opportunity to meet him at a conference on driving change in the retirement industry through innovation and policy at Georgetown Law School. As a follow-up, Treasurer Chiang and Katie Selenski, the Executive Director of CalSavers, stopped by Guideline HQ for a full debrief on the program, and a look at how they’re working to help prepare Californians for retirement.

From left to right: Guideline’s General Counsel & CCO, Carol Ho; Katie Selenski, Executive Director of CalSavers, California Treasurer John Chiang, and Guideline Chief Operating Officer, Jeff Rosenberger.

The issues at stake

Of the 7.5 million uncovered California workers, two thirds work for small businesses with fewer than 100 employees, two thirds are workers of color, and 58% are women. According to research compiled by CalSavers, lack of access is critical because workers who are offered a workplace retirement plan are 15 times more likely to save for retirement. Being unprepared for retirement has a negative impact on families’ quality of life — retirement incomes for half of Californians are projected to fall below the threshold for “serious economic hardship” — and it creates a larger burden on the government because 62% of retirees rely on social security for more than half their income.

Around the country, several states have been considering measures to make retirement plans more accessible for small businesses and their employees. State Senator Kevin de Leon brought the movement to California in 2008 when he started agitating for legislation to help uncovered private sector workers. After iterating on the policy idea for a few years, the first legislation for CalSavers was passed in 2012 as the first state law passed for auto-IRAs, followed by a mandated feasibility study and then passage of the revised law in 2016.

CalSavers to the rescue

Like the other auto-IRA programs that have come along, CalSavers is designed primarily as a Roth IRA. It will feature auto-enrollment (which means employees have the option of opting out) with default contributions of 5%, and annual auto escalations until employees are saving 8% of salary each year. The program will be administered professionally by a private firm (TBD) with oversight by the Board and State Treasurer as the Chair, similar to California’s 529 college savings program.

By 2022, California employers with five or more employees will have to choose between offering a retirement savings plan from a provider like Guideline or enrolling employees in the CalSavers program. The pilot program launched in 2018, and larger employers are required to add a retirement plan in 2019.

The program will be developed at no cost to taxpayers, and will be paid for by employee participant fees which are expected to shrink as the program scales up.

Guideline’s perspective? CalSavers is intriguing.

At Guideline, we are generally supportive of these state-run programs. First and foremost, we think automatic enrollment is a great idea. From survey research we’ve conducted, almost half of workers would be somewhat or very happy to be automatically enrolled in a retirement plan. And only 13% would be very unhappy.

Among employees who aren’t offered a plan, we also saw that “ease of savings” would be their top reason for participating. CalSavers clearly removes barriers that currently keep employees out of work-sponsored plans — and we think it can succeed as long as rollouts are handled smoothly and the program is able to keep fees low.

As a useful precedent, 529 college savings programs have now achieved a level of scale at over $300 billion in assets over the last two decades, despite the fact just 3% of the population uses them. One interesting development in the 529 space is that the largest state programs in terms of assets don’t directly correspond to the largest population states: Virginia has the most total assets with an advisor-sold model followed by New York and Nevada.

Are we competing?

We don’t really see auto-IRA programs like CalSavers and OregonSaves as competition for our 401(k) plans. If anything, the employer mandate to offer a plan is likely to expand the size of the 401(k) market — especially for low-cost providers like us.

Plans styled around Roth IRAs make more sense for businesses with lower paid and more transient workers. At some level, these programs are designed as a safety net for basic savings for the most vulnerable workers — and they also have the benefit of allowing workers to draw on their contributions for emergencies.

For the majority of workers, 401(k) plans will remain the most important retirement savings vehicle. Built-in payroll deductions, pre-tax savings, higher contribution limits, and the opportunity for employer matching mean 401(k) plans can have a much bigger impact for employees who are able to save more (or who work for more generous companies).

Offering a great 401(k) will also give small businesses a strategic advantage when competing for talent in a robust labor market. Here’s a quick look at how CalSavers and Guideline stack up:

| CalSavers | Guideline | |

| Plan type | Roth IRA | 401(k) |

| Can employers make matching contributions? | No | Yes |

| 2019 contribution limits | $6,000 | $19,500 (and up to $57k with employer matching) |

| Pricing | There are no fees for employers | Starts at $39 + $8/month per participant |

| Who pays for plan administration? | Employees | Employers |

| Auto enrollment? | Yes | Yes |

We are supportive of Treasurer Chiang and the CalSavers team, and we’re excited to watch the program develop as they begin the pilot phase later this year. Helping more of the 7.5 million uncovered California workers plan for retirement is a worthy goal and we hope it sets a good example (and makes the case) for other states to follow suit.