How to help your clients choose the right 401(k) plan

Okay, so maybe your client has asked you if they should offer a 401(k). Or maybe you’ve suggested that they offer one. Either way, do you really know how to help them pick the right plan? There are lots of variables to consider, so you’ll want to be familiar with all the angles.

Note that this article is part two of a three article series designed to help accountants and bookkeepers with their small business clients. If you’d like to learn more about why you should be prepared to advise clients about retirement plans — or need answers to clients’ most common questions — check out our other two articles:

- Part 1: Why tax pros should be up to speed on retirement plans

- Part 3: Quick answers to your clients’ 401(k) questions

What should acountants look for in a 401(k) provider?

When a business chooses to offer a 401(k) plan, there are a number of responsibilities that need to be accounted for. Some full-service 401(k) providers handle most or all of these responsibilities, or plan sponsors can use multiple vendors and/or take on some of the work themselves.

These are the tasks that need to get done to offer a plan and keep it compliant:

Plan design and setup: Prepare required plan documents, coordinate contributions with your payroll provider, trustee and custodian (and request a letter of determination from the IRS, if not using a pre-approved document).

Enrollment and education: Manage participant eligibility and enrollment, explain your plan to employees, educate them on investment options, and give them required information, notices and disclosures.

Administration and recordkeeping: Deposit contributions and deferrals with the custodian, and keep track of all transactions and balances.

Distributions & Benefit Payments: Administer benefit distributions, loans, hardship withdrawals, required minimum distributions and Qualified Domestic Relations Orders.

Compliance and reporting: Prepare and file Form 5500 and schedules annually, perform annual nondiscrimination testing and manage any compliance-related refunds

Investment management: Choose a diverse selection of investment options. Ensure investment decisions are correctly executed and tracked. Regularly review the composition of the line up to assure that the investment options selected, retained or removed from the line up follow a process designed with the best interests of participants in mind, and timely communicate any changes to the participants.

In advising a client, you should be looking to help them find a provider that does these things well — and at a reasonable cost to the business and plan participants. For example, many providers pass a lot of their expenses on to employees through high fees on assets under management. Others charge additional fees for certain aspects of their service — like annual Form 5500 filing — or outsource portions of their service to other providers who charge their own fees.

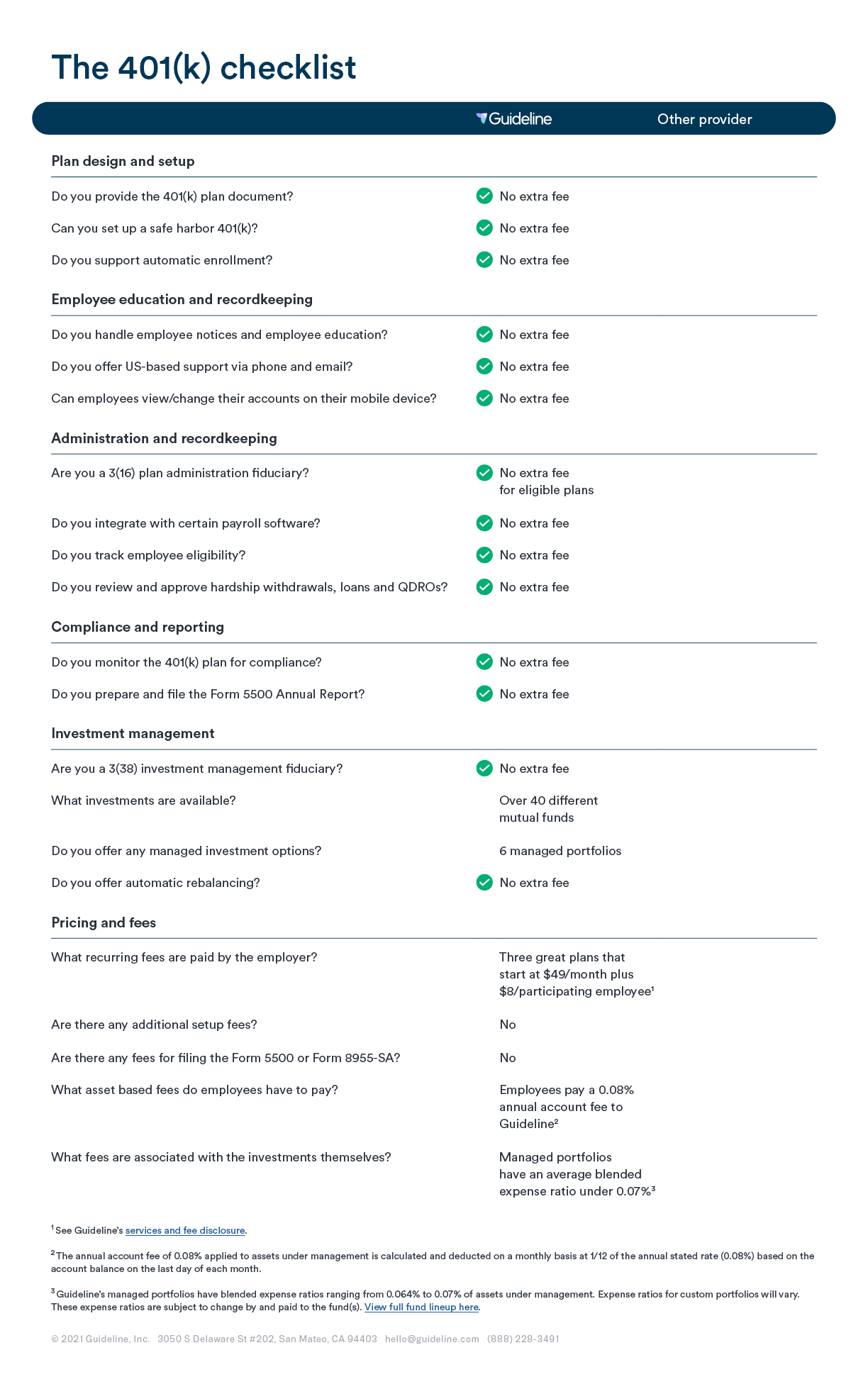

Here’s a complete checklist of what to look for in a provider (and a rundown of what Guideline does):

In addition to the responsibilities above, you may also want to look for a provider that makes it easy to maintain the 401(k) plans of multiple clients. When you’re looking at providers, you may want to ask whether they have a single interface to keep all your clients organized. Or whether their service automates some of the administration by integrating with the accounting or payroll software you use.

As an example of what’s possible, see how we help accountants and bookkeepers. And on behalf of your clients and their employees, thanks for putting in the due diligence to find a provider that will help them meet their retirement goals. You can learn more in parts one and three of this series:

- Part 1: Why tax pros should be up to speed on retirement plans

- Part 3: Quick answers to your clients’ 401(k) questions

This content is provided for informational purposes only and is not intended to be construed as tax advice. As a tax professional, it is your responsibility to ensure you understand tax regulations and take your clients’ unique circumstances into account when furnishing tax advice.