How to balance paying off student loans while saving for retirement

Paying off student loans is a huge undertaking and a monumental achievement for millions of Americans. Based on Federal Reserve data, student loan debt in the US reached about $1.68 trillion as of June 2020, with student loan debt growing around 7% annually since 2010.

According to Forbes, there are approximately 45 million Americans that currently have student loan debt. This means that about 18% of the US population aged 18 and older has student loans, with the average amount of student loan debt being $32,731.

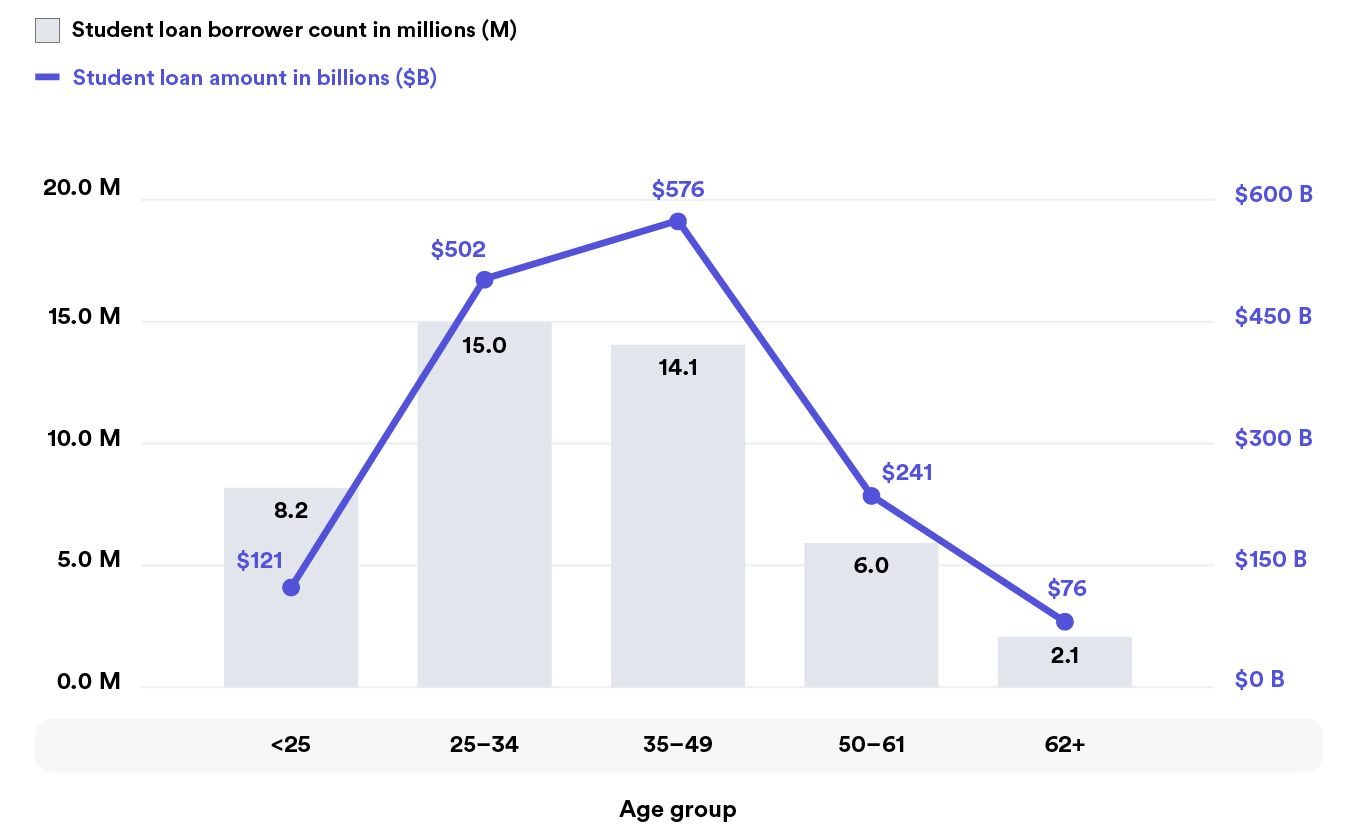

Looking at the breakdown of student loans by age group in 2019 (chart below), age groups 25 to 34 and 35 to 49 have the most student loan borrowers and student loan amount.

- 82% of all student loan borrowers are less than 50 years old

- 64% of all student loan borrowers are between the ages of 25 and 49

- 71% of the total student loan amount is held by Americans between the ages of 25 and 49

As the chart shows, student loan debt most affects people ranging from 25 to 49 years old. For those paying off student debt, the idea of saving at the same time—be it for retirement, a down payment, a wedding, or an emergency fund—can seem impossible. But choosing between paying back loans or saving for the future doesn’t have to be a binary choice.

Thanks to annual returns and compound interest, small savings today can provide a major boost to your long term savings. With a sound strategy and plan, you can chip away at your student loans AND chip in to your retirement savings. Here are some actionable steps to consider as you create a roadmap to financial wellness.

Make the minimum payments on your student loans

Already making the minimum payments on your student loans? Keep it up! If you’re not, this should be the top priority. Missing minimum payments can lead to late fees and can have negative effects on your credit score.

Contribute to a 401(k)

If you have some money leftover after making your minimum payment and your company offers a 401(k), consider opening an account.

Consider contributing enough to earn the full match, if offered. For example, if your employer offers a 100% match on deferrals up to 3% of compensation, consider contributing 3% of your compensation to your 401(k) so that you receive the full match from your employer.

If there isn’t an employer match, contribute an amount that you can afford. Remember long-term returns and compound interest can help grow any retirement savings, and contributions to a 401(k) are deducted from each paycheck using pre-tax dollars. This can lower your taxable income which means you may owe less in income taxes for that year.

Open an IRA

Don’t have a 401(k) plan at work? No problem. You can still open up an individual retirement account like a Roth or traditional IRA. The annual contribution limit on IRAs isn’t as high as 401(k) plans, but IRAs are a great option that can help grow modest savings over time and provide some tax advantages.

Look at your high interest student loans

As you may know there are both federal and private student loans with varying interest rates. If you have student loans with high interest rates, consider prioritizing paying off those student loans first to reduce your interest payments. Depending on how many high interest student loans you have, you may want to consider whether it’s worth reducing a 401(k) contribution a little in order to pay off high interest rate student loans quicker.

Add more financial tools

There are a lot of companies that can help you work toward financial wellness, offering everything from health savings accounts to emergency fund accounts to student loan refinancing. These benefits range from the employer making payments towards employees’ student loans tax free or offering a nonelective contribution on repayment of student loans.

There’s also an additional benefit—traditionally, employers’ payments towards employees’ student loans were treated as wages but, due to the CARES Act, until December 2025 employers can make payments toward their employees’ student loans on a tax free basis (up to $5,250 annually).

This means that employees can receive contributions toward their student loans from their employer without paying any taxes on the contributions (up to $5,250 annually), which allows employees the chance to save money on interest and pay off their loans more quickly!

Financial wellness should be attainable at every stage of life—whether you’re just graduating from college or nearing retirement. Finding a balance between paying bills today and saving for the future is a big part of that.

At Guideline, we offer low-cost mutual funds, charge low monthly account fees, and have eliminated transaction fees—all so individuals can have more control over their retirement accounts, and keep more of their investment growth. With the right strategies and a sound game plan, we believe everyone can arrive at a secure retirement and enjoy the journey along the way.

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax, legal, personal investment, and/or financial advice that considers all relevant facts and circumstances. You are advised to consult a qualified financial adviser or tax professional before relying on the information provided herein.

Sources: