How to coach yourself through investing in a bear market

When you decide to invest your money, you are balancing how much risk you want to take with the amount of reward you might get. The potential reward you can earn for every dollar you risk on investment is called the risk/reward ratio. The riskier an investment, the higher the potential reward should be.

However, saving for retirement is different from saving for other goals because you are not significantly impacted by periods of volatility. Saving for retirement is usually a long term investment goal, so you can afford to take a bit more risk—short-term volatility isn’t going to matter if your retirement is 30 to 40 years out.

Have we seen this before?

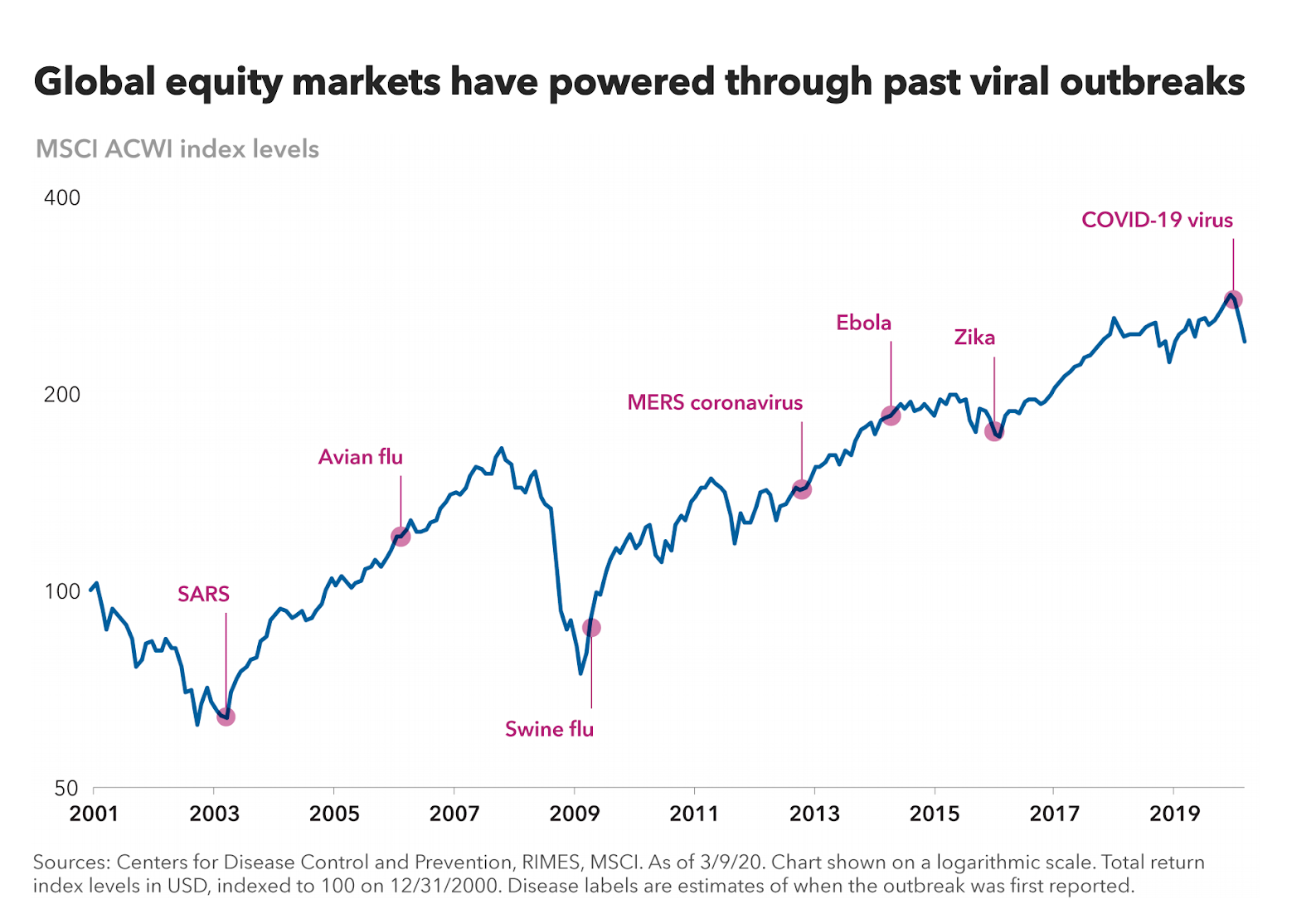

We’ve seen viral outbreaks before but none, in recent times, have affected the economy or global stock markets as much as COVID-19.

This graph shows the MSCI global equity index from 2001 to March 9 of this year—just days before the market low on March 23. While the chart might be a couple months behind, the general takeaway still holds true: markets heal quickly from disease outbreaks and they will rebound from their lows.

While this stock market index originated in 1990, we do know the world’s economy bounced back from similar pandemics like cholera in 1832, the bubonic plague in 1900, the Spanish flu in 1918, and the Hong Kong flu in 1968.

The world’s economy will always have setbacks, and we will never really know when they are coming. However, when they do happen, it’s important to remain calm and continue to look at the big picture.

Coaching yourself through market volatility

1. Ignore stock market predictions: It’s important to know that no one can predict the stock market 100% of the time. Therefore it’s best to ignore predictions you read in the news that are ultimately meant to be sensational. Selling out on the market to buy back in later means you may lose out on gains. Especially with a long term savings goal like retirement.

2. Focus on the long term: When you are investing for the long term, it’s important to seek perspective. You need to emotionally ignore stock market dips and continue to focus on the eventual gains.

3. Maintain a diversified portfolio: Different market indexes will have different paths, so it's important to maintain a diversified portfolio. Diversification allows you to flatten out your risk over the long term, while still taking advantage of eventual gains. If you are investing in a variety of index mutual funds, certain indexes will be down, while others are up. This can help your portfolio weather market downturns—even global ones.

4. Stay the course with your allocations and investments: If you have a properly diversified portfolio geared towards your retirement goal, you should always remind yourself to stay the course. With your 401(k), that means maintaining your investment allocation, rebalancing your account if your allocation is off target, and continuing to contribute to your account every pay period.

Your chosen portfolio allocation should already reflect potential market volatility throughout the years, and by investing when the market is low, you’re getting a better deal on pricing.

Recessions are painful, but expansions are powerful

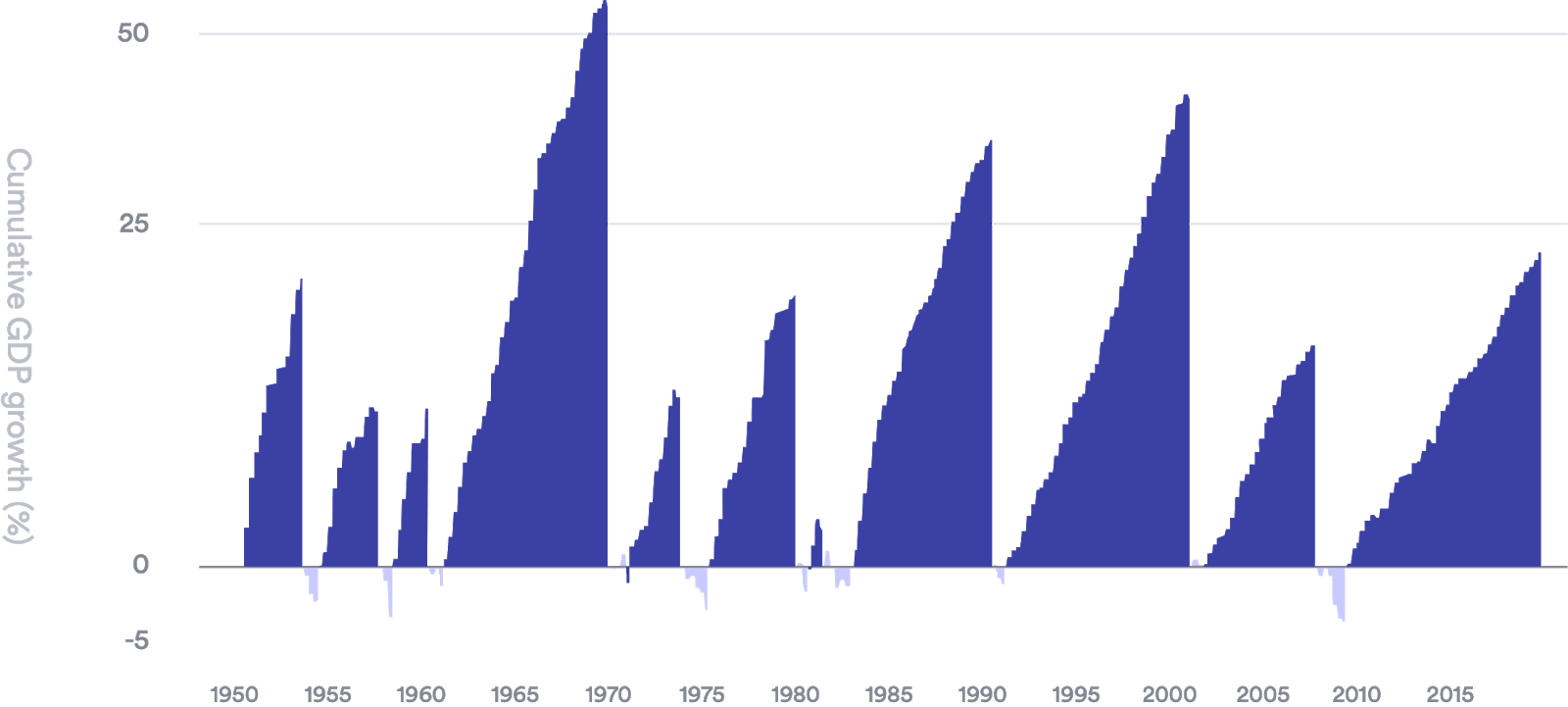

Another great way to gain perspective is to look at our country’s GDP growth. The dark purple in this chart illustrates expansions, and the light purple illustrates recessions. The expansions are much bigger and more common than the recessions, with the average expansion at 67 months, and the average recession at just 11 months.

While we can’t know exactly how long this upcoming recession will last, judging by history it’s likely to be shorter than the next expansion.

How to stay calm in turbulent times

There are a number of things you can do both as an individual investor as well as with your investments to stay calm in turbulent times. We’ve put together this checklist to not only help you through this current market downturn, but to help you coach yourself through long term investing.

1. Review your finances

Check your safety net: The standard rule of thumb is to have 3-6 months worth of living expenses in cash.

Review your next-line reserves: Figure out where you’d access funds if your cash accounts were depleted. The CARES Act provisions makes it easier for retirement savers to access their funds, but they should not be your first option.

Review your contribution amount: If you are confident in your financial safety net, consider increasing your contributions.

2. Review your asset allocation

Is your portfolio diversified? If no, time to revisit your portfolio allocation. If yes, great! You’re already on track to withstand future market changes.

3. Check your investment mindset

Are you reacting to markets emotionally or logically? If emotionally, identify how you might be reacting.

- Confirmation bias: giving more weight to trends you already believe in

- Availability bias: giving more weight to recent events

- Framing bias: letting the presentation of info affect your interpretation

Has your appetite for risk changed? If yes, time to revisit your portfolio allocation. If no, great! Stay the course and look out for future gains.

Revisit your long term plan: Has your retirement date changed? Have you experienced a big life event? (i.e. job loss, birth of a child, buying a home, etc.) If nothing has changed, then you should still be on track!

4. Look out for tax-saving opportunities

If you’re a business owner, offering a 401(k) adds up to really big tax savings thanks to the SECURE Act. If you’re an individual investor, consider converting your traditional contributions to Roth if you think you might find yourself in a lower tax bracket in 2020.