Job growth among Guideline clients is strongest in finance, real estate, and technology

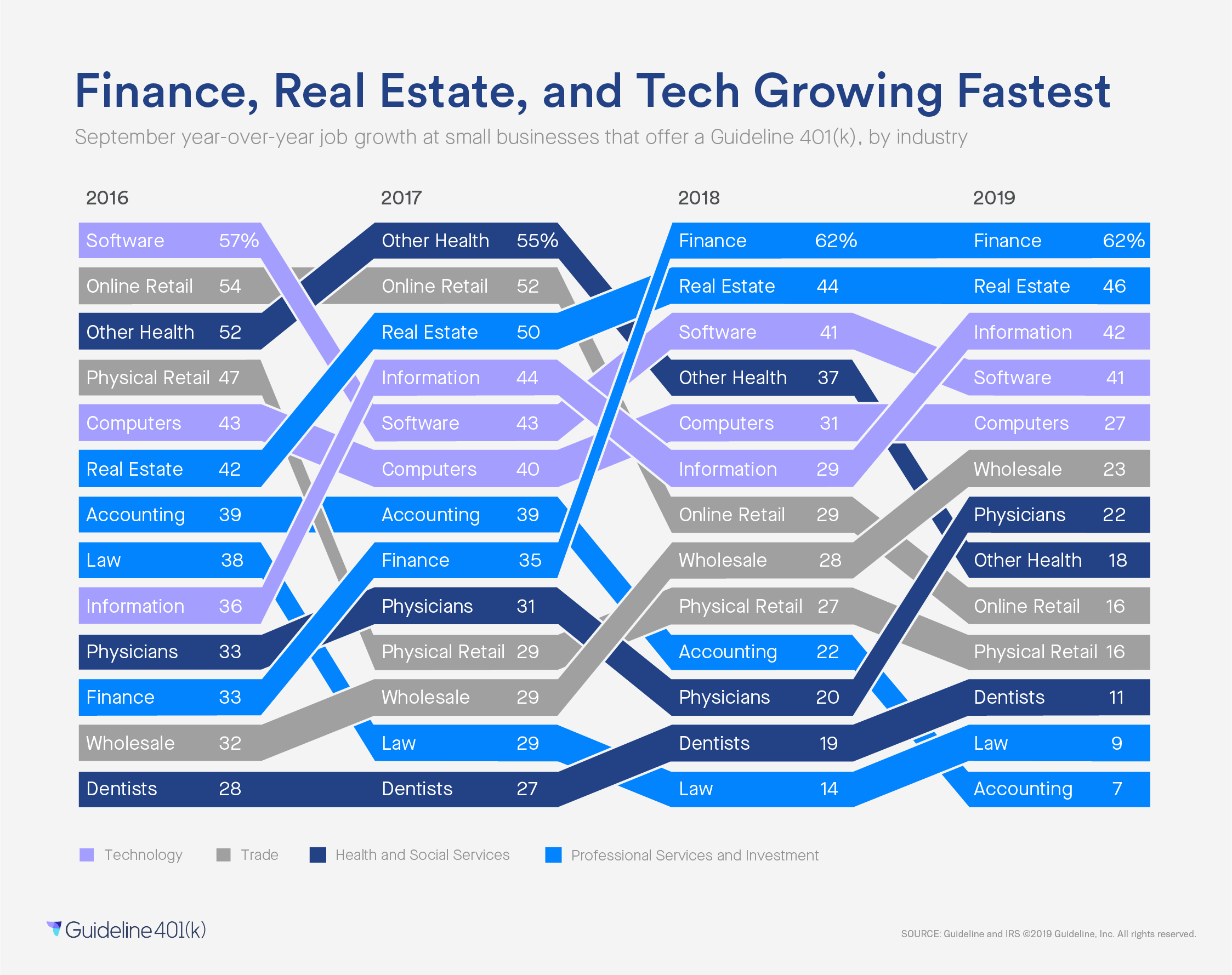

Among companies offering a Guideline 401(k), those in finance, real estate, and technology showed the strongest growth in jobs in the twelve months leading up to September 1, 2019.

The most robust hiring was in finance and insurance, which saw an exceptional 62% net increase in jobs; and in real estate rental and leasing at 46%, according to Guideline’s analysis.

Three technology-related industries followed, with information (which includes data-related services as well as publishing and subscription programming) at 42%; software publishers at 41%; and computer systems design at 27%.

Job growth in the finance sector has accelerated aggressively in recent years, moving from a growth rate of 33% in 2016, which put it near the bottom of this list of industries, to 62% in 2019. Real estate has also climbed in the rankings, inching up from 42 to 46% from 2016 to 2019, while several other industries saw their job growth rates decline.

At the bottom of the list this year are accounting (which includes accounting, tax preparation, bookkeeping, and payroll) at 7%, down from 39% in 2016; and legal services at 9%, down from 38% in 2016. Another industry which continues to grow but at a slower pace is online retail, which had an increase in jobs of 16% in 2019, versus 54% in 2016.

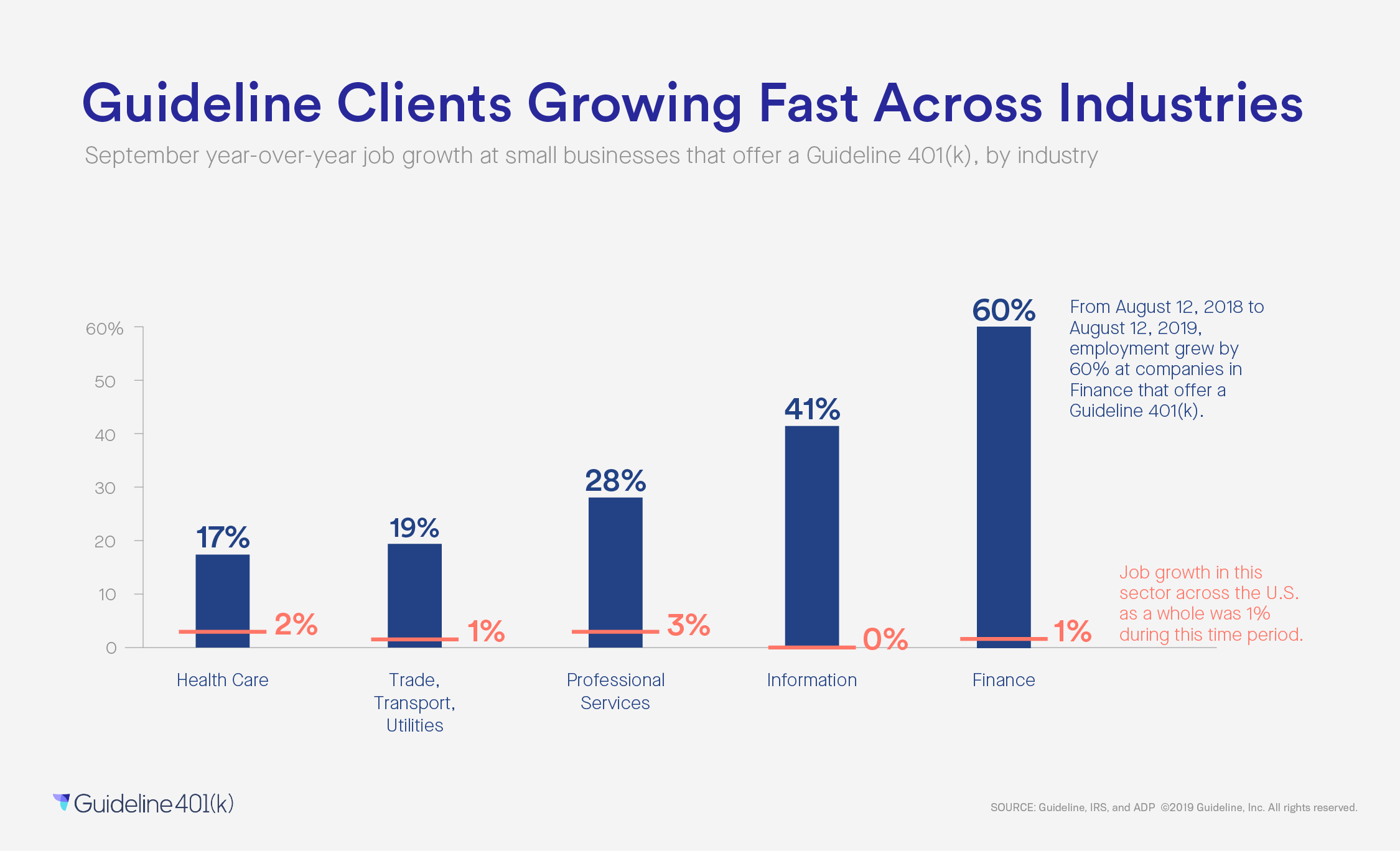

We wanted to see how this rate of job growth compares with other companies in these industries, so we compared our data to ADP's estimates of job growth across the U.S. economy as a whole. It turns out that across all of the industries that we looked at, job growth among companies offering a Guideline 401(k) has far surpassed overall job growth nationwide.

For example, whereas ADP data indicates that the overall job growth was 3% in the professional services sector in the twelve months leading up to August 12, 2019, Guideline clients in this area saw a job growth rate of 28%. Similarly, ADP’s data shows a 0% growth rate--or no change in the number of jobs over the past year--in the information sector, whereas among companies offering a Guideline 401(k) the number of jobs increased by 41%.

You may notice that the two charts have slightly different numbers; that’s because the second chart matches some methodological features of ADP’s analysis in order to better compare our data with theirs. You can read more about this in our Methodology section, below, and we should note that even with these adjustments, the way in which we came to our numbers is different from ADP.

We’re reporting actual job gains and losses at companies offering a Guideline 401(k), whereas ADP uses multiple data points to estimate jobs across the economy as a whole. Other differences are that ADP’s data here includes companies of all sizes, whereas most Guideline clients are small businesses; and ADP’s data includes job gains and losses due to companies opening and closing, whereas we’re only counting company expansions and contractions.

While this comparison is therefore is not exact, we believe that the strong job growth we’re seeing at Guideline clients across industries has to do with the kind of small business that chooses a Guideline 401(k). A small business that elects to offer a 401(k) to its employees tends to be doing well financially, and is investing in an improved employee experience, often in the context of growth.

Does this data tell us how easily we might be able to find a job? Not necessarily. These job numbers refer to industries, not roles, so a new accounting position in an insurance company would be counted as a job in the finance and insurance industry, rather than accounting.

The job market also continues to evolve: the Bureau of Labor Statics (BLS) recently released its projections for job growth from 2018 to 2028 by occupation, and three of the four top occupations are related to health and personal care, which in recent years has been among the slower-growth industries in Guideline’s data.

There are also areas of alignment between the industries that are booming in our analysis, and the BLS occupation projections. For example, two of the fastest-growing and highest-paid occupations according to the BLS are financial managers, with median annual earnings in 2018 of $128K, and projected 16% growth in the number of jobs from 2018 to 2028; and application software developers, with earnings of $104K and 26% growth during this time frame.

Guideline offers easy, low-cost 401(k) plans for small businesses. You can get started with Guideline at www.guideline.com, or email us at hello@guideline.com to get answers from a specialist.

Methodology

We analyzed anonymized employment data from over 9,000 companies that offer Guideline 401(k) plans. Our analysis counted job gains from company expansions and job losses from company contractions, but not gains and losses due to companies being founded or going out of business. Companies were classified into industries based on the North American Industry Classification System (NAICS) code each company selected in their Form 5500 publicly filed with the Internal Revenue Service (IRS).

For the “Finance, Real Estate, and Tech Growing Fastest” chart, data was counted from September 1 to September 1 of each year. In this chart: Finance refers to the NAICS ‘Finance and Insurance’ sector, and Real Estate refers to the ‘Real Estate Rental and Leasing’ sector. Physicians refers to the ‘Offices of Physicians’ industry group and Dentists refers to the ‘Offices of Dentists’ industry group, within the ‘Health Care and Social Assistance’ sector; while Other Health refers to all other industry groups in this sector.

Online Retail refers to the ‘Electronic Shopping and Mail-Order Houses’ industry group in the ‘Retail Trade’ sector; and Physical Retail refers to all other industry groups in this sector. Wholesale refers to the ‘Wholesale Trade’ sector. Law refers to the ‘Legal Services’ industry group and Accounting refers to the ‘Accounting, Tax Preparation, Bookkeeping, and Payroll Services’ industry group, both within the ‘Professional, Scientific, and Technical Services’ sector.

Computers refers to the ‘Computer Systems Design and Related Services’ industry group within the ‘Professional, Scientific, and Technical Services’ sector; while Software refers to the ‘Software Publishers’ industry group within the ‘Information’ sector.

Finally, Information refers to the ‘Data Processing, Hosting, and Related Services,’ ‘Cable and Other Subscription Programming,’ and ‘Newspaper, Periodical, Book, and Directory Publishers’ industry groups within the ‘Information’ sector.

For the “Guideline Clients Are Growing Fast Across Industries” chart, data was counted from August 12, 2018 to August 12, 2019, in order to provide a comparison with ADP’s estimates. In alignment with ADP’s methodology, for this chart, Health Care refers to the ‘Health Care and Social Assistance’ sector; Trade, Transport, Utilities refers to the ‘Retail Trade,’ ‘Wholesale Trade,’ ‘Transportation and Warehousing,’ and ‘Utilities’ sectors; Professional Services refers to the ‘Professional, Scientific, and Technical Services’ sector; Information refers to the NAICS ‘Information’ sector; and Finance refers to the ‘Finance and Insurance’ sector. ADP's data in this area does not include the Real Estate sector.

Media requests, questions, and comments about this data can be sent to data.research@guideline.com.