Investing 101: Portfolios

When it comes to saving for retirement, there’s a whole world of themes and terminology that can feel difficult to understand, especially if you’re a business owner offering a 401(k) for the first time or a new saver trying to determine how much money to set aside. At Guideline, our mission is to provide a path to a secure retirement for everyone — and knowledge is the first step on that path.

In this post, we’ll define what an investment portfolio is and explore the role diversification plays in meeting your savings goals.

What is a portfolio?

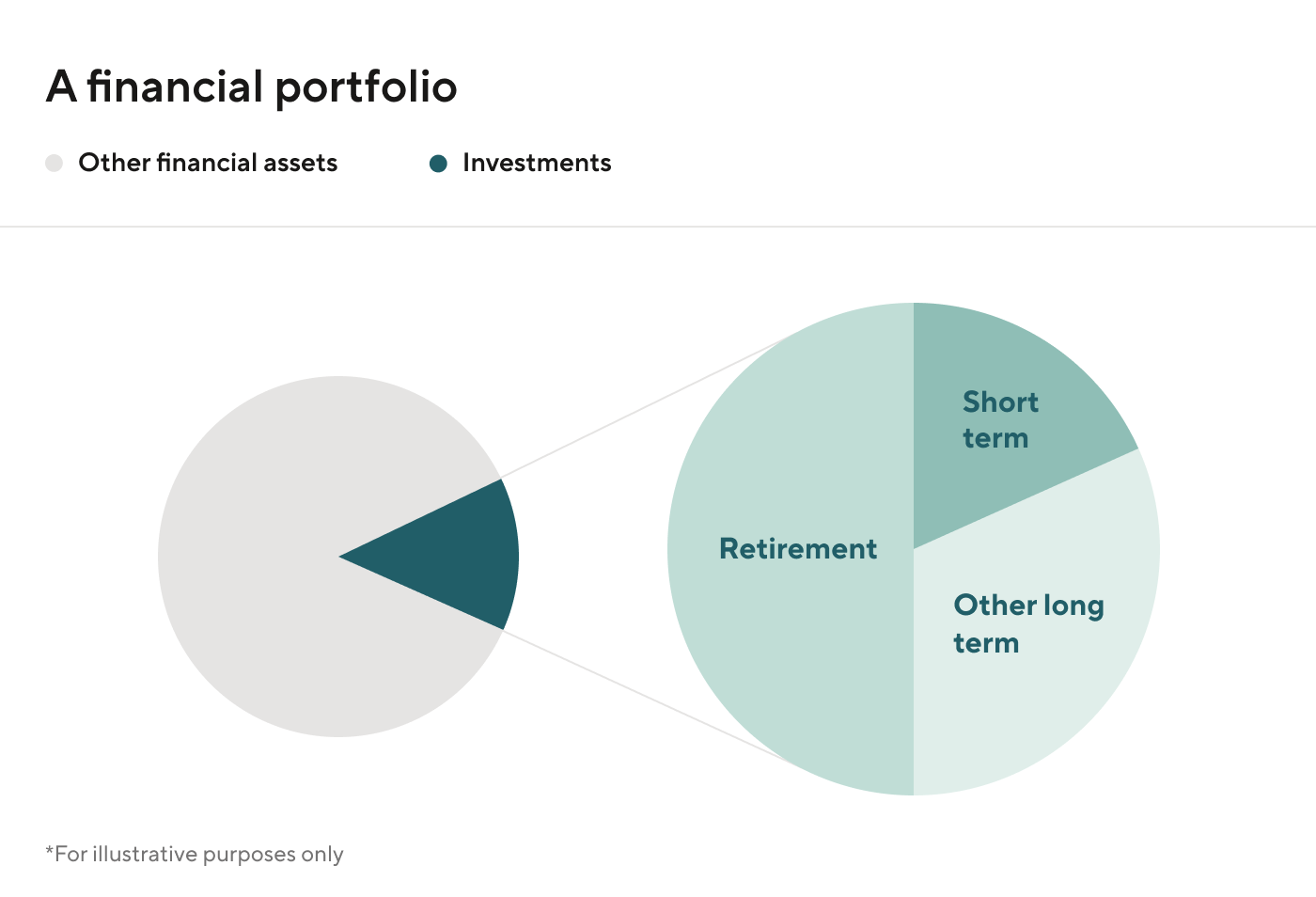

In general, when discussing your finances, a portfolio refers to your mix of financial assets and investments, like cash, real estate, stocks, bonds, and more. Some find it helpful to think of a financial portfolio as a pie chart, where each of your different assets represents part of your whole. If you were to focus solely on the ‘investments’ slice of pie, you’d have a portfolio there as well — and thus, another pie chart. That’s the one we are going to focus on.

As the name suggests, an investment portfolio is a mix of different investments. You may have heard someone say “diversified portfolio” before — this is in reference to having a mix of investments in your portfolio that reflects your risk-reward ratio as an investor. Your risk-reward ratio is how comfortable you are with taking on risk in exchange for the possibility of a reward. This general theory applies to investing for retirement as much as it does investing as part of your broader financial profile. A key factor in the risk-reward ratio is the time horizon you have until you’ll need to use those funds, which factors into whether you’re investing for the short or long term. We cover that here.

How do I choose an investment portfolio?

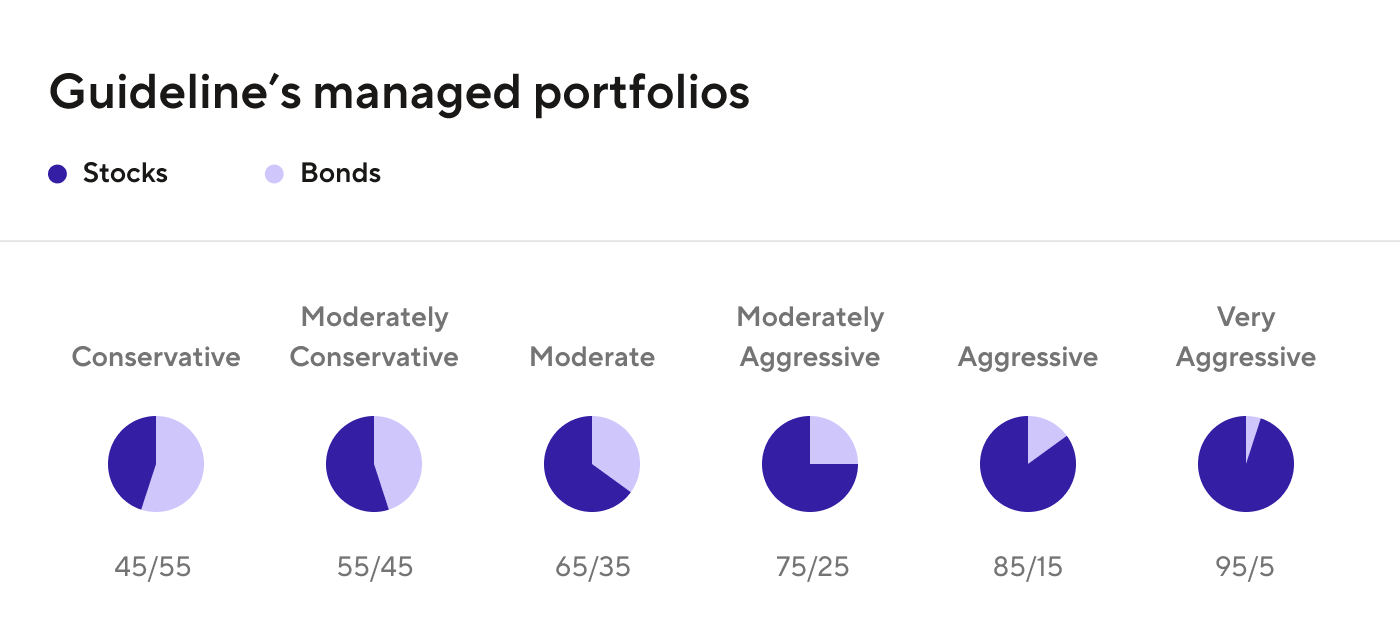

At Guideline, in an effort to make saving for retirement more approachable and more affordable, we’ve created six different managed investment portfolios. Each is diversified and aligns with a range of time to retirement and risk tolerances so you select what works for you.

When getting started with Guideline, savers can select one of these six portfolios or opt to create a custom portfolio. Our short online questionnaire can help you discover your tolerance for risk and will recommend which of our portfolios best suits your needs. In addition to assessing how comfortable you are with risk; we take into account how many years there are until you’re planning to retire. For example, a younger individual with a longer time horizon until they plan to retire can accommodate more risk — and thus the possibility for more reward — because there is time for bigger market swings to balance out.

How many portfolios can I have with Guideline?

With traditional 401(k) providers, you may be able to decide to change your investment allocation for future deposits in a separate portfolio, while keeping your current allocation intact in your present portfolio. Guideline doesn't provide for this option because we don't believe it makes sense for your retirement portfolio.

When a participant goes through our suitability process, we assess time horizon and risk tolerance with their retirement age in mind and recommend a portfolio allocation we believe is correct for their circumstances.¹ This portfolio allocation becomes the "target allocation" for your Guideline account, and all assets in this should be invested accordingly in order to reach that goal.

Given this intent, there is rarely a reason for future contributions to be allocated differently from current holdings. Instead, if the target allocation changes for some reason, the entire portfolio should change. In other words, you should think of your retirement account as one whole portfolio, instead of breaking it up into what has been invested during different periods of time.

Now that you’ve conquered portfolios 101, here are a few more stories we thought might be useful:

- Automatic rebalancing? Expense ratios? Graded vesting? Get a quick crash course in all things retirement with our 401(k) glossary.

- Learn about the differences between traditional and Roth 401(k) accounts with our comprehensive guide.

- When it comes to saving for retirement, it’s all about the long game. Learn about how compound interest and dollar cost averaging can help grow your savings over time here.

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax advice that considers all relevant facts and circumstances. Guideline makes no representations or guarantees with regard to investment performance as investing involves risk and investments may lose value. Clients should consult a qualified investment or tax professional to determine the appropriate strategy for them.

¹ As a robo-advisor, once an individual completes the suitability assessment, which is a simple questionnaire, Guideline recommends one of our six professionally managed portfolios composed of mutual funds via our proprietary software. Guideline does not provide individual investment advice.