Oregon’s Trailblazer for Auto IRA: A Q&A with Lisa Massena

Recognizing workers’ need for better access to retirement savings programs, most states (46) have introduced legislation or enacted programs for state-sponsored retirement programs over the last decade. Lisa Massena is the former Executive Director of OregonSaves. With the State’s Treasurer Tobias Read, they led the charge for Oregon’s program, which launched in 2017. It was the first of its kind to be implemented and is today recognized as a leading model for auto-IRA programs.

In 2020, Lisa formed her own consulting group Massena Associates, working with states, private sector providers, and policy organizations on retirement security initiatives. She has also worked with Ascensus on their Government Savings Team and led investment analytics units for State Street Bank. We wanted to learn more about what worked for Oregon’s successful program.

The views and opinions expressed in this interview do not necessarily represent the policies and positions of Guideline. The content of this interview is for informational purposes only, and should not be interpreted as tax, investment, financial, or other advice.

GUIDELINE: You helped lead the pioneering effort for the first state auto-IRA program, OregonSaves, which now covers all private-sector employers in the state that do not provide their own plans. What unique challenges did you face working with state legislators? Any advice for people in other states working on programs?

Guideline Team, I’ll start by saying thank you for having me – it’s my privilege to talk with you! In Oregon we faced a challenge states commonly come up against: what’s our real retirement savings gap, and what is the best way to close it. We worked with local and national level experts to develop fresh data on the gap, and to think about the program models that would give us, as Oregonians, the greatest likelihood of successfully starting to close that gap.

If I have any advice, it might be that data matters. Get good data before you get too far in. And, if you are serious about closing the retirement savings gap take a good look at the options available: some are proving to be more effective than others.

GUIDELINE: To date, nine states have passed legislation authorizing auto-IRA programs, and many others are considering them. Why do you think the auto-IRA model is proving out to be more viable than the marketplace model?

Here’s what we are seeing so far. First, what really works to expand the number of people saving is automatic enrollment. You want to get folks automatically enrolled so that they’re on a good path even if they do nothing. Of course, you want to also give them the ability to opt out and not save if they really don’t want to.

The second thing that works is expanded workplace-based coverage – making sure retirement savings is available to folks right where they are getting their paycheck.

The third element folks like is account portability, which is something IRAs offer but it’s still a little more cumbersome with the average 401(k) account.

The marketplace model is great in theory — you can see here Washington state’s version. But in practice, marketplaces have been shown to increase retirement coverage only a small amount. As of June 2020, Washington’s program was serving fewer than 20 businesses and 150 workers, and had accumulated about $1.3 million in assets.

By contrast, the Oregon program of a similar vintage was serving 6,000 employers and 70,000 savers who had socked away almost $60 million. And the numbers are much higher today.

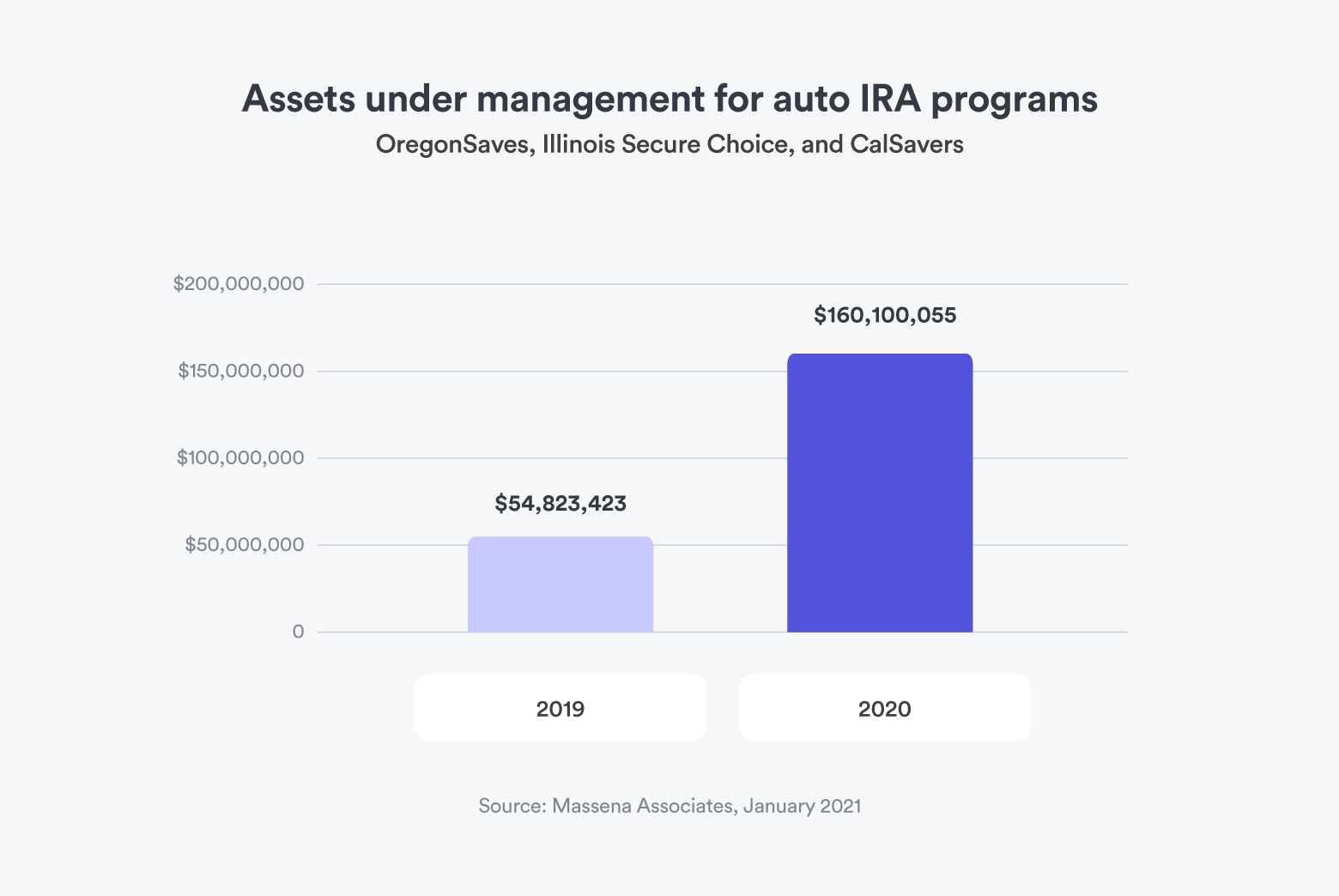

GUIDELINE: In your newsletter Retirement Security Matters you track AUM for state auto-IRA programs. The data has shown healthy growth in the last year, even in a year when disruptions from the pandemic could have easily slowed growth. What do you attribute this to? How does this growth stack up against early predictions about adoption and funded accounts?

Response to these programs during the pandemic has been amazing. The workforce and families gaining access to retirement savings through Auto IRAs overlap significantly with the folks who’ve also experienced the most job-related pandemic impact. And yet, there’s such a hunger to have something socked away that every program has shown an increase in the number of savers, savings, and facilitating employers every month during 2020.

Growth is very steady. I suspect it’s consistent with the experience we had when 401(k) plans were introduced for the first time in the 1980’s – and you see what’s happened there.

GUIDELINE: The data also shows the average account balance for an individual saver is just over $600. Given that state programs predominantly serve LMI (low and moderate income) workers, what do you say to critics who might argue that that same $600 is better put into a worker’s pocket today — rather than into long-term retirement savings?

It’s interesting to think about this. A restaurant worker saving through Illinois Secure Choice shared his experience with the program’s administrators in an interview: “Just today I was on the L and I was thinking about how I was drowning in red ink and all these debts. And then I realized, Oh, I've got this money set aside that offsets the debt. I may be in the black now, for the first time ever. That just felt so good to me.”

I think we need to recognize that folks’ financial situations are dramatically improved even when they have a small savings cushion available to them. And how much more powerful is this when people know they did it themselves out of their own income?

The latest data from OregonSaves shows an average account balance of almost $1,000 per saver. That’s powerful.

GUIDELINE: There’s been some new research this year about the link between having emergency savings and the need to tap retirement funds in a crisis. Add to that, there is growing momentum among recordkeepers to add emergency savings tools into their products. What are your thoughts on bringing emergency savings into retirement financial services?

I like retirement-linked emergency savings. I think it’s a really simple concept that can and does work well. I’d like to see way more adoption of these approaches, and common use of automatic enrollment. Automatic enrollment really works for us as busy people.

GUIDELINE: Another topic that is growing in popularity since the pandemic started, is the future of work. Looking ahead, how do you think the changing workplace, and benefits, will impact the future of retirement?

Employment seems to be becoming more “on-demand” and “at will” than it was when I first entered the workforce. That means people work for more employers and in more employment situations, with interesting implications for retirement coverage and portability.

In this variable environment if we want people to do a good job of saving for retirement we need to make sure they are continuously offered an opportunity to save for retirement at work, where the paycheck is happening, and on an automatic basis.

We also need to make sure retirement assets are portable – that they tend to flow into a single account rather than proliferating into many smaller accounts – so that people can see what they have and manage it as a single chunk of retirement-income-generating assets.

GUIDELINE: Your career has spanned both private and public ventures—and now you’ve started your own consulting group. What is your new team focused on?

We focus on retirement savings initiatives that increase coverage, use, and income. We work directly with states who are legislating for or implementing state-facilitated retirement savings programs. Colorado, North Carolina and Virginia are three great examples.

We also work with private sector providers who serve or want to serve states. And we work with policy organizations to set strategy and directly support retirement savings innovation by states and providers. Because our expertise straddles the public, private and policy spaces we can get people focused on the right actions quickly and cost-effectively. And, we love our work.

GUIDELINE: There are some great hidden gems in your newsletter for readers, including what’s on your bedside reading table. Care to share what you’re reading now?

Yes! I will give you two nuggets. I’m currently listening to the Professional Troublemaker podcast by Luvvie Ajayi Jones. Spicy! And as a project I’m reading my way through the U.S. presidents. I’m just wrapping up Rutherford B. Hayes and his Civil War diary is a must read. Next, we’re heading into president #20, which is James Garfield.

Here’s a site I use to pick my reads (thank you Steve!) So – I’ll take some input – which one of Steve’s four recommendations should it be? I’m leaning in the direction of Garfield: a Biography but Dark Horse is looking super-tempting too.

Special thanks to Catherine New for her help on this article.